Opploans' terms range from nine months to 24 months, depending on the state you live in, while Oportun's lengths are one to four years. Possible has only one term length: two months. However, you'll only be able to take out up to $500, and the lender charges extremely high APRs, so other lenders may be a better option if your credit is in good shape or if you need a more substantial amount of cash. The company doesn't check your FICO score and markets itself as a payday loan alternative. Possible caters to borrowers who have limited borrowing options because of their poor credit scores. If you don't live in one of those states, you'll have to choose another lender. Loans are only available to residents of AL, CA, DE, FL, ID, IN, IA, KS, KY, LA, MI, MS, MO, OH, OK, RI, SC, TN, TX, UT or WA. Almost all other lenders offer phone, mail, or in-person support in addition to email support. You are only able to contact Possible via email.

#Possible finance app download plus#

Depending on the state you live in, you'll pay either a flat fee between $15 to $20 for every $100 borrowed, or a monthly fee plus interest. As the company markets itself as an alternative to payday loans, it makes sense that the maximum loan amount would be lower. Possible lets you borrow up to $500, which is much lower than what you can get with other personal loan lenders. The APRs on Possible's loans range from 54.51 to 240.52% - substantially higher than with many other personal loan lenders, but lower than with payday lenders. Payday loans and other alternatives don't allow you to build your credit score. Beware that if you fall behind on your payments, your credit score could be dinged.

#Possible finance app download series#

For borrowers looking to build credit, a series of consistent, on-time payments on a Possible loan can boost your score.

Reports payments to major credit bureaus.However, at the interest rates the lender charges, you may be better off borrowing the money from friends or family, if this is an option for you.

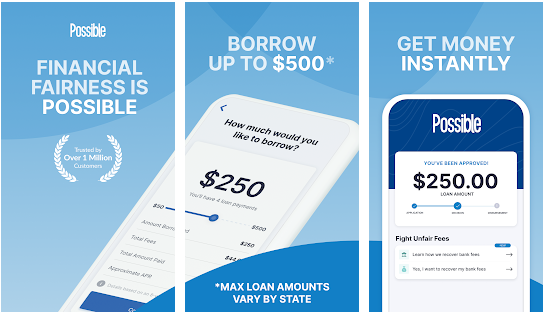

Possible offers loans for as little as $50, which may appeal to borrowers who need a small amount of cash to tide them over. Possible Finance Personal Loan Pros and Cons Possible Finance Pros Possible has one repayment term length of two months. You should consider lenders with lower rates before choosing Possible, though it may be a good option if you have limited or bad credit. The APR on Possible's loans ranges from 54.51 to 240.52%, which is higher than what most other personal loan lenders charge. Payday loans can trap borrowers in a cycle of debt because the high interest rates may make it hard for you to pay back the money on time while interest continues to accrue on the balance. The lender pitches itself as an alternative to payday loans, which are high-cost, short-term, unsecured loans that have a principal that is a portion of your next paycheck. Personal loans provide cash for expenses such as debt consolidation, medical bills, and home improvement projects. Possible offers loans between $50 and $500. Possible Finance Personal Loan Amounts and Interest Rates The best personal loan for you depends on your credit score, which will determine what you qualify for and can lower your rate. However, borrowers with poor credit and limited alternatives will find the company is a better choice than a payday lender. The bottom line: Possible offers loans with very high interest rates and operates in a limited number of states, making it a bad option for many borrowers.

0 kommentar(er)

0 kommentar(er)