- DOUBL ENTRY BOOKKEEPING EXAMPLES SOFTWARE

- DOUBL ENTRY BOOKKEEPING EXAMPLES TRIAL

- DOUBL ENTRY BOOKKEEPING EXAMPLES FREE

DOUBL ENTRY BOOKKEEPING EXAMPLES FREE

Use our free tool to compare accounting software.

DOUBL ENTRY BOOKKEEPING EXAMPLES SOFTWARE

Completing an invoice from the software will automatically complete the posting for you, increase your sales, and increase your customer’s balance. An example of this is if you raise an invoice on a customer. As you complete your transaction, the numbers automatically post to the accounts. The advantage of software for your accounts is that the figures are calculated for you. For most businesses, there are several choices these include using Excel, FreshBooks, Xero or QuickBooks or other online accounting services. Many different software packages will complete the bookkeeping double entry system for you. They are also used to produce end of year accounts.

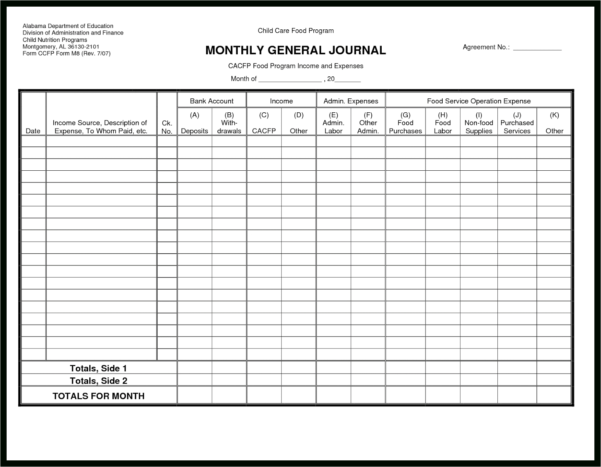

Using both of the reports will help a business make financial decisions. The Income Statement or Profit and loss account comprise of income, cost of sales and expense accounts. Balance SheetĪ balance sheet is a snapshot of the business’s position and includes assets, liabilities and Equity. There are two main financial statements the Profit and Loss Statement or Income statement and the balance sheet. Once all the transactions are complete, the financial statements are produced. Double Entry Bookkeeping – Financial Statements Increase the accounts receivable account by £200 (Debit), and increase sales by £200 the sales figure will make up part of the retained earnings on the balance sheet, which will post as a credit. Our second double entry bookkeeping example is for a business that invoices a customer (the debtor) for services of £200 for payment at a later date. Small businesses and non-profit organisations mainly use it.īelow are two double entry bookkeeping examples:Ī business buys stock for £700 using its bank account two things need to happen – the bank balance needs to be reduced by £700, and the stock or inventory needs to be increased by £700. A single entry system will show the income, expenditure and bank balance It’s the most straightforward and cheapest form of accounting. One of the advantages is that it helps to minimise errors in the accounting system compared to a single entry. A few adjustments may be made for cheques not cleared, or deposits are not showing on the bank statement. You can also check the figures by looking at the individual accounts like the bank, making sure the value in your accounts is the same as the figure on your bank statement on the same date. If mistakes are made, it is possible to make a journal entry to correct them.

DOUBL ENTRY BOOKKEEPING EXAMPLES TRIAL

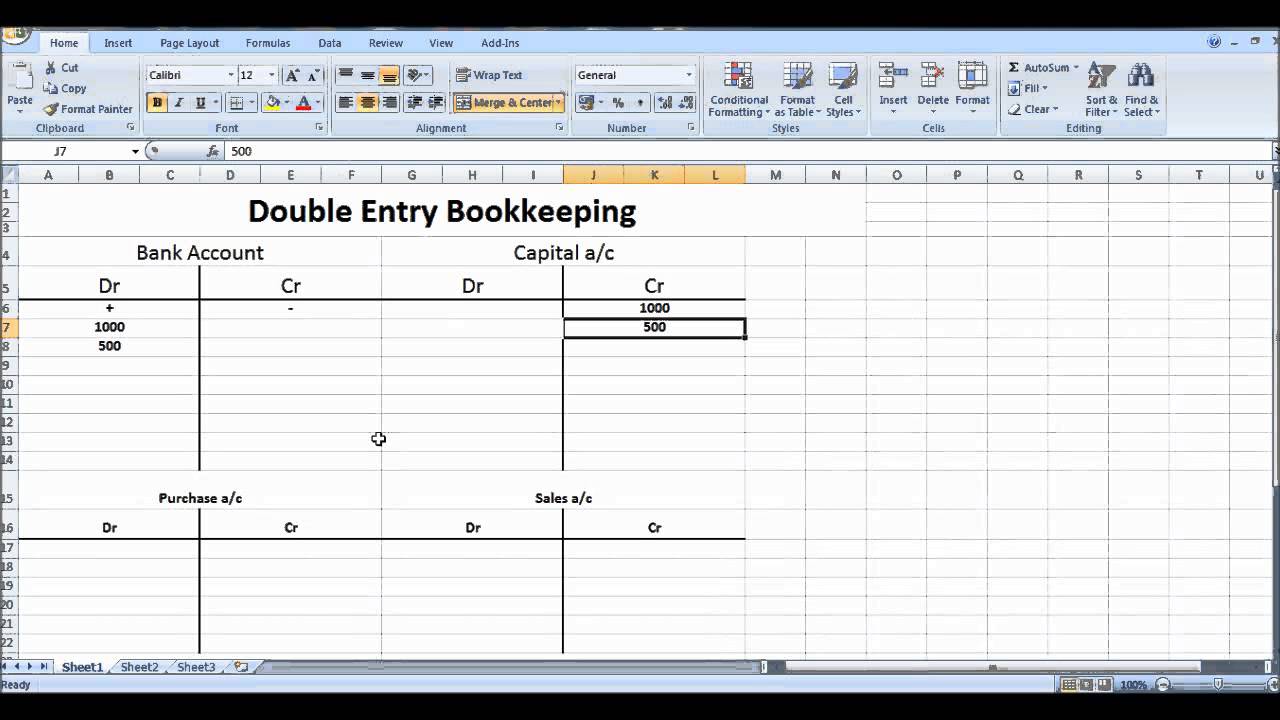

The trial balance should be equal on both sides if not, an error has been made. It includes all the debits and credits from the Profit and loss and balance sheet reports.Ī trial balance helps to check for any mistakes n the accounts. The adjustments are made on the same side of the equation and remain balanced.Ī Trial balance will show all the account balances for the general ledger. If using the example of purchasing a computer at 500.00, they use the bank account instead of using credit. When making a double entry transaction, you may make the adjustments on the same side of the equation. The accounts payable account will also increase by an equal amount therefore, the equation remains balanced. The computer is classed as an asset and will increase the asset account. A business transaction is made, the company purchase a new computer for 500.00 on credit.

To help understand the equation better, we will look at an example. Liability Account – Accounts that the business owes, including loans, accounts payable, taxes due and accruals.Įquity Account – Includes owner’s equity, shareholders investments and retained earnings. The equation must always balance.īelow are some of the general accounts that make up each of the items on the equation.Īssets Account – This is accounts that a business owns, including bank, cash, accounts receivable, computers and prepayments. To help understand double entry bookkeeping, you need to look at the accounting equation.

0 kommentar(er)

0 kommentar(er)